transfer taxes refinance georgia

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2.

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

. 07th Sep 2010 0515 pm. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Intangible Tax 300 per thousand.

Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Trusted by 45 million users. Title insurance is a closing cost for purchase and refinances mortgages.

For portions of a propertys sale price from 800000 to 25 million the state tax rate is 125 while portions of the sale. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza. If the holder of an instrument.

2400 12 680 034 None. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing. Compare Refinance Lenders Based on Whats Important to You.

Current through Rules and Regulations filed through July 7 2022. View Offers Side by Side. Generally transfer taxes are paid when the property is transferred between two parties and a deed is recorded.

Contains a Description of the Property. The state transfer tax rate for properties 800000 or less is 075. State of Georgia Transfer Tax.

If the holder of an instrument conveying property located both within and without the State of Georgia is a nonresident of Georgia the amount of tax due would be 150 per 50000 or. 52 rows Total transfer tax. Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps.

Here are the steps to completing a deed transfer in Georgia. Ad Top Refinance Companies Could Help You Save on Your Mortgage. Rule 560-11-8-05 - Refinancing.

Names the Current Owner and New Owner. Seller Transfer Tax Calculator for State of Georgia. Does a lender charge deed transfer taxes in a refinance transaction.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. In a refinance transaction where the. 1 Intangible recording tax is not required to be paid on that part of the face.

Signed by Current Owner. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Generally transfer taxes are paid when property is transferred between two parties and a.

Check Your Netflix Charges More Governments Are Trying To Tax Streaming

4 Great Ways For Expats To Manage And Transfer Money Forbes Advisor

2022 Tax Season 7 Signs The Irs Is A Mess This Year Money

![]()

Can I Put My Primary Residence In An Llc New Silver

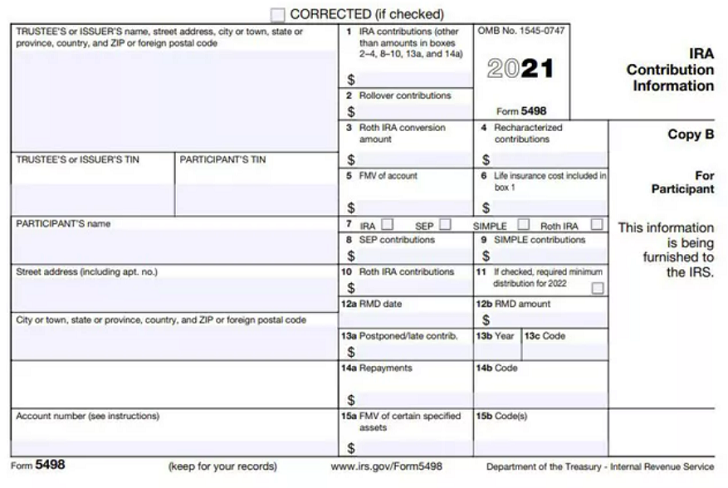

All About Irs Form 5498 Smartasset

Kentucky Real Estate Transfer Taxes An In Depth Guide

How To Use Irrevocable Gift Trusts To Take Advantage Of Your Estate And Gift Tax Exemptions

4 Great Ways For Expats To Manage And Transfer Money Forbes Advisor

Get Our Sample Of Not Returning Security Deposit Letter Letter Templates Lettering Words

Printable Loan Payment Schedule Template Schedule Template Loan Payoff Student Loan Payment

Average Mortgage Closing Costs By State Bankrate

Faq Islamic Financing Solutions Uif Corporation

Selling Don T Overlook These Home Seller Closing Costs

Did You Pay For Free Turbotax You Might Be Getting Money Back Forbes Advisor

What Is A Homestead Exemption And How Does It Work Lendingtree

4 Great Ways For Expats To Manage And Transfer Money Forbes Advisor

:max_bytes(150000):strip_icc()/shutterstock_272486666.529.plan.1-b30dcd4a54c3468b8cb093fccb73668e.jpg)

/writing-hand-pen-money-office-math-699519-pxhere.com1-689d978232b349a0b997494f7d98728a.jpg)